برای تجربه بهتر در این وبسایت، لطفا از صفحه نمایش بزرگتر استفاده کنید.

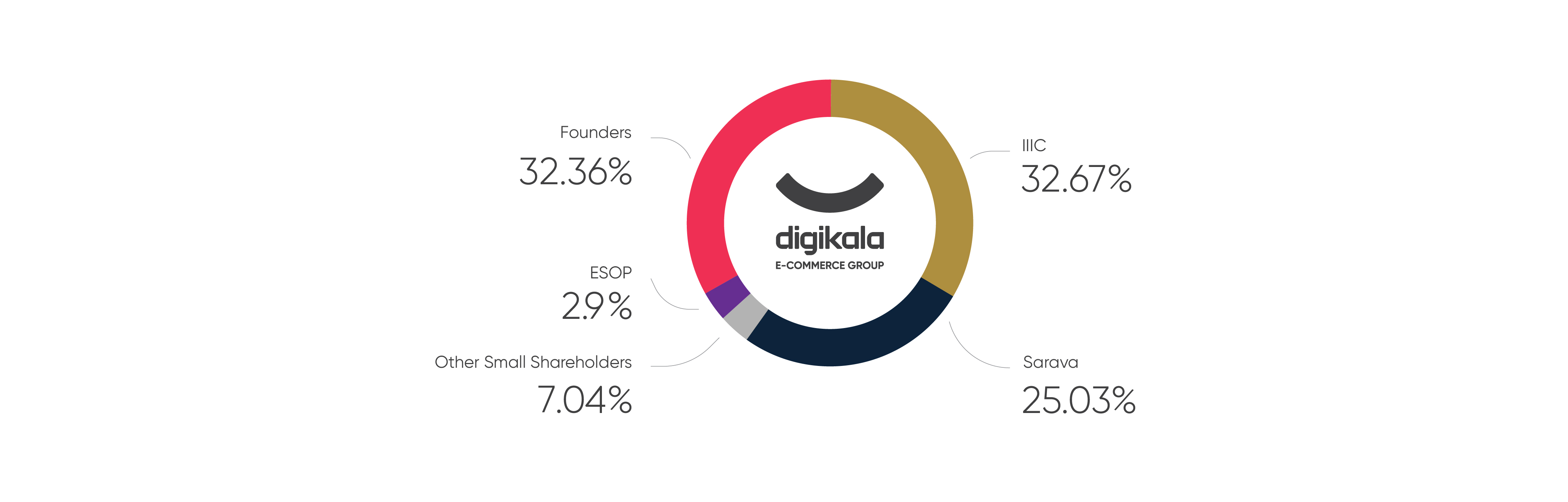

Digikala E-commerce Group Shareholding Structure

Digikala (Noavaran Fanavazeh) was founded by Hamid Mohammadi and Saeid Mohammadi in form of an Ltd. company with limited funds. The initial version of the corporate experienced significant growth through bootstrapping (meaning with very little money and no outside investments) only during the next 6 years.

According to the development of Digikala business and the necessity of fundraising, the first step of investment was made via Sarava Pars company in 2012. Sarava is a non-governmental investment company that along with other internal investors, supports young Iranian entrepreneurs in the way of creating unique value for reaching their passions.

The second round of fundraising was provided by International Internet Investment Coöperatief (IIIC) in 2016. This 100 million dollar investment was the first foreign direct investment in Digikala. The process was accomplished through the Foreign investment promotion and protection act (FIPPA) and the Organization for Investment Economic and Technical Assistance of Iran (OIETAI).

IIIC is an investment holding company that was incorporated on 22 October 2015 by a team of European investors for investment in internet technology and e-commerce businesses in the Middle East. IIIC was established under Dutch laws in the Netherlands as the most suitable structure for experienced European investors to invest and local private sector entrepreneurs to have access to the highest quality international funding to scale their startups.

The founding investors of IIIC are all European entities with substantial international expertise in investment in the e-commerce and technology sector with the highest standard of transparency and compliance. As an example, Pomegranate investment AB, which holds 28.62% of IIIC is a public company in Sweden. IIIC is bounded by the highest standard of financial transparency and reporting and complies with all applicable laws, including anti-money laundering and sanction laws.

Digikala owes its growth to its employees. In this regard, Digikala has dedicated some part of its sharing to its key managers and colleagues in form of an Employee Stock Option Plan.

In 1400 and the formal launch of Digikala e-commerce group, the ownership of Digikala (Noavaran Fanavazeh) along with its shareholding structure was transmitted to the aforementioned group.

Other shareholders companies in Digikala e-commerce group can be named: Lilian Mode Tejarat, Bazaar Ati Ara, Pomegranate Investment AB, Kia Asa TejarateToos, and Pars Gostar Dina.

To summarize, Digikala group shareholding structure as total owners of Digikala (Noavaran Fanavazeh) in order:

Hamid Mohammadi and Saeid Mohammadi hold 32.36 percent of Digikala group shares,

32.67 percent of Digikala group shares are allocated to IIIC,

Sarava Pars company holds 25.03 percent of Digikala group,

Key managers and employees use 2.9 percent of Digikala shares as ESOP,

the remained 7.04 percent of Digikala shares are dedicated to other shareholder companies.